Introduction to Malaysian Derivatives (Revised Edition)

- Regular price

- RM 32.00

- Sale price

- RM 32.00

- Regular price

-

RM 0.00

Share

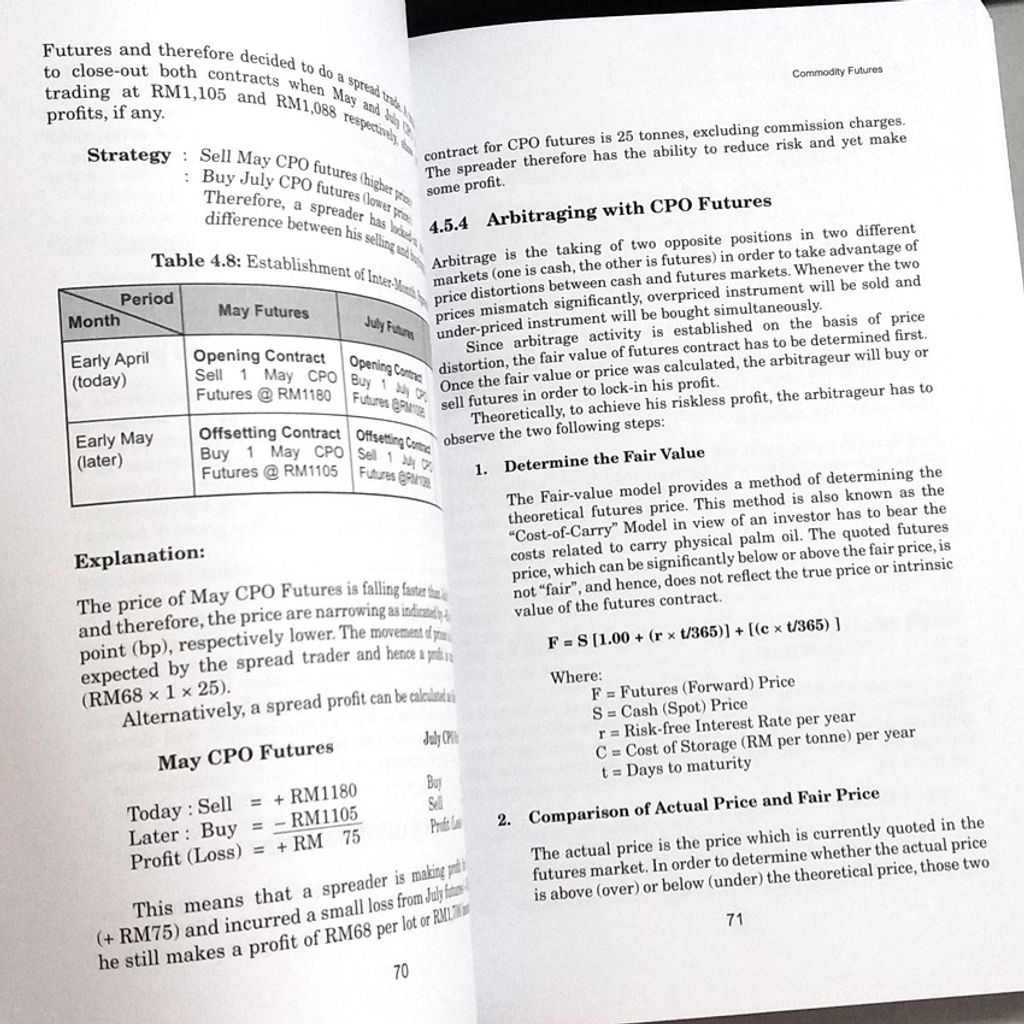

This derivative textbook explains derivative concepts and principles in clear simple terms so that they can be readily understood. In addition, students will find the examples and cases inside authentic and practical, as they apply to the Malaysian context.

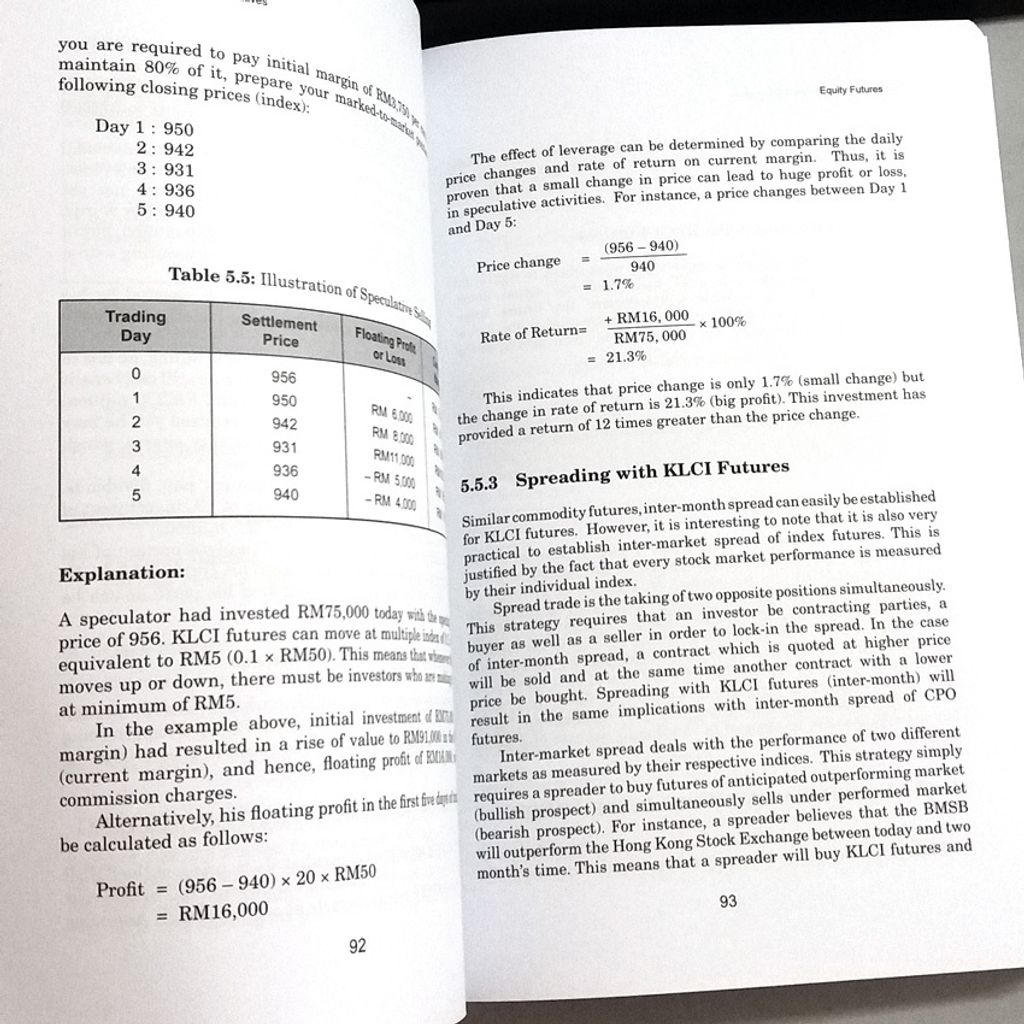

The first part begins with an overview of financial markets and institutions. It goes on to introduce the concept of derivatives. Part 2 of the text explains the principles of futures and trading strategies of commodity and financial futures. Mechanics of hedging, speculating, spreading and arbitraging with palm oil, index, interest rate, bond and single-stock futures are well-discussed in the Malaysian derivatives market.

Part 3 introduces the principles of options and discusses the trading strategies of index options and stock options. It discusses clearly on the basic strategies of call and put options, explores further on synthetic strategies of the straddle, strangle and spread for unlimited profits and limited losses and explains briefly on valuation models of options.

The final part discusses on the market structure and other Malaysian derivatives. It extends its discussion on the functions of derivate exchange house and clearinghouse in Malaysia, and market analysis of palm oil, stock and fixed-income investments. It extends its discussions on other derivatives with references to swaps and warrants, and ends up by reviewing on Malaysian unit trusts.